Calculating Food Cost

Chefs are managers and must be able to control food costs in the kitchen. Those who are unable will be out of a job quickly. But controlling costs is everyone's responsibility, and the chef must convey this message to their culinary team, from the cooks to the dishwashers. Food costs are tied to properly training your crew so that they can be efficient, control portion sizes, and reduce food waste. Here are a few more ways to control costs.

How to Calculate Food Cost

The two ways foodservice establishments use to determine food costs are:

Theoretical Menu Plate Cost – Individual portion cost for each menu item

Overall Food Cost Percentage – Based on the monthly cost of food as compared to sales

Calculating Theoretical Plate Cost

Calculate each menu item's cost and include all plate components. Plate cost includes production trim, waste, and meat or vegetable trimmings. Some plate costs use multiple preparations, such as the truffle demi-glace in this recipe, which requires the preparation of brown stock and a brown sauce before the small sauce is made. Other recipes, like the potato pave, will have trim from peeling and cutting the potatoes, plus the waste from portioning them. These factors must be considered before an actual plate cost can be determined.

Photo by Loija Nguyen on Unsplash

Example:

Angus Filet Mignon, 8oz - Menu Price $49

Chipotle Coffee Rub, Truffle Demi-Glace, Haricot Vert, and Potato Pave

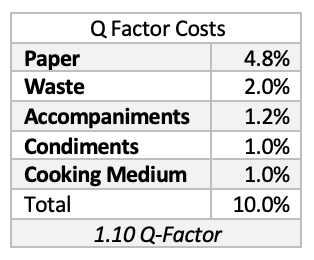

Q Factor

Complimentary Items such as bread, butter, salt, pepper and other condiments must be factored into a food cost

A Q factor is the cost of anything extra required in the production and service of the menu item. These include complementary items like bread, butter, and even salt and pepper. Typical Q-factors add about 10% to the food cost.

Q Factor Itemization

Salt & pepper

Sugar

Lemon wedges

Condiments, ketchup, mustard, salsa & chips, soy sauce, hot sauce

Crackers

Bread or rolls

Butter

Garnish for the plates

After dinner mints

Ice for water glasses

Amuse bouche

Waste from overproduction, spoilage, or improper cooking (re-fires, burned, etc.)

Q Factor can be as much as $3 in a sit-down restaurant.

Determining Menu Price

Menu price is determined by several factors, including:

Food cost percentage

Perceived customer value

Competitor prices

Menu mix

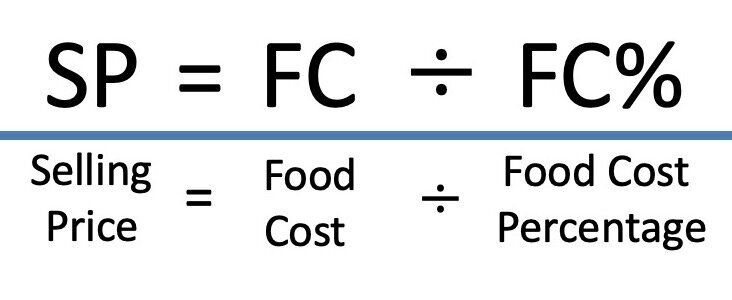

Menu Price Based on Food Cost Percentage

Once a plate cost is established for a menu item, the selling price can be set. Typical food cost percentages run 20-40% of an establishment's overall operating cost. Most sit-down restaurants are in the 30-35% range. Caterers and banquet operations, because of guest count guarantees and set menus, could have food costs in the 25-30% range. To determine the menu price, use the following formulas.

Menu price based on a 30% food cost the formula:

$7.15÷.30 (30%) = $23.83

The menu price would be rounded up to $24 or even down depending on:

Perceived customer value

Competitor pricing

Menu mix

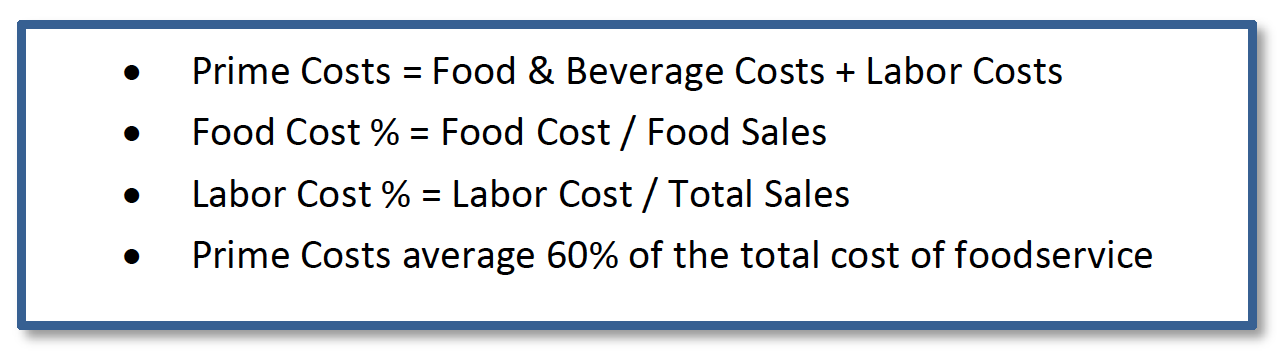

Theoretical Budgets

Foodservice operations will set a theoretical budget with sales goals and projected spending targets for food, labor, and overhead. The projected budget is an estimate based on sales history and forecasting trends for both sales and expenses of the operation. Setting a budget helps to focus the operation's goals so that the manager and chef can make adjustments as needed to maintain financial stability.

Actual Food Cost

This is determined by taking a physical inventory and comparing it to actual sales. This method requires accurate and consistent inventory recording. The mark of a well-managed operation is how close the theoretical and actual budgets come together.

Actual Food Cost Formula

Menu Mix, Menu Pricing, and Margins

Lobster can gross more raw dollars than less expensive items on the menu like soups or salads

Some menu items have higher profits and lower costs than others. Soup and pasta are typically low-cost/high-markup items. Some menu items, like soup, may have a 10% food cost, while others, like steaks and lobster, could be 40% or more. The goal in writing a menu is to have a balanced mix of menu items to achieve a consistent overall food cost that aligns with the monthly operating expenses.

Raw Dollar Revenue and Menu Mix Comparisons

Just because a menu item like soup may have a low food cost percentage doesn’t mean you can bank the operation's success solely on soup. Lobster tails may have a high food cost percentage but will bring in more raw dollars than the soup. Analyzing raw dollar revenue will reveal that certain items, although high in food cost, can yield more income for the establishment.

This menu mix shows an average food cost of 32%. While soup, salads, and chicken have lower-than-average food costs, steak and lobster are higher. Selling 20 soups at a 20% food cost sounds good, but it only brings in a profit margin of $80, while selling 20 lobsters will yield $500. Lobster brings in more raw dollars per item and a higher profit margin than soup. If more lobsters are sold, it will bring in more revenue than an equal number of chickens or steaks. So food cost percentage is only one factor to consider when determining the menu mix and pricing.

Foodservice Income Statements

Income statements show the earnings from the sale of food and beverages and the expenditures on goods, services, and overhead. They are usually completed monthly and compared with sales history to determine whether sales and costs are as projected.

Cost to Sales Ratio

Because raw dollar costs are hard to compare from one period to the next, a cost-sales ratio is commonly used and displayed as a percentage of sales. By analyzing the cost ratios, the operator can easily target problem areas. These areas can be investigated, and changes can be made to maximize profits.

Example:

Food Cost in Perspective

The foodservice business operates on very thin profit margins. Food is not the sole cost of running a food business. Here is an example of a pizza's food cost and sales price. While the profit on this pizza appears to be over $10, additional costs must be considered, including labor, rent, and other expenses. Once these costs are calculated, profit margins are typically in the 3-5% range.

Ways to Control Food Costs

Kitchen Organization – Establish a standardized system for ordering, receiving, storing, and production

Employee Training – Train everyone to follow the system by adopting standardized recipes and procedures that control portions, use trim and leftovers efficiently, and reduce spoilage and waste.

Standardized Recipes and Procedures –This is done so that there is consistency in production and food costs

Menu Costing – By calculating a per portion plate cost for each menu item, a realistic selling price can be set

Portion Control—One of the easiest ways to control the cost of food is to establish standardized portion sizes and train employees to use them.

Production Forecasting—By using sales history to determine production, you can reduce food waste and overproduction. Establish a prep sheet with par levels for all food items to help your staff plan production.

Overproduction – This results from a lack of proper forecasting based on a sales history, which increases waste not just in food but also in labor costs

Improper cooking and re-fires – Proper staff training will reduce waste occurring from improper food preparation

Using leftovers and Trim—Repurposing trim or the overproduction of food for other preparations is a trick that will help reduce waste and increase profit margins.

Ordering – Improper ordering of food leads to spoilage and ties up money in excess inventory

Inventory—A regular inventory is vital in determining whether costs align with the budget. A physical inventory is usually done once a month but may be done weekly or even daily if food costs are uncontrollable.

Theft - Dishonest employees always find a way to steal, so tracking inventory and securing expensive food items will help reduce costs

Waste - Properly trained employees waste less and are more conscientious; periodically check to see what gets thrown out

Purchasing Analysis – Having an alternate vendor for your food and beverages allows you to do comparison shopping to keep purchasing costs in line.

Sales and Service – An established training program will reduce “comps” resulting from poor service and ensure that the staff charges the correct menu item prices.