Everything to Know About Cultivated Meat

You've probably heard about cultivated meat—genuine meat developed from cells taken from living animals—and its potential to disrupt the traditional way meats are produced. It may be easy to dismiss cultivated meats as a fad; however, well over $2 billion in venture capital has poured into this emerging technology in just ten years. Big players, from billionaires like Sergey Brin (Google) and Bill Gates (Microsoft) to Michelin-starred chefs and celebrities, have thrown their weight and money into it. Some of the world’s largest meat companies, including Tyson, Cargill, and JBS, have also invested in its potential. Although currently only legal to sell in Singapore, there is growing acceptance that this technology is close to ramping up to full-scale production and may start selling in the United States soon.

Why Cultivated Meat?

You may be asking yourself why chefs and consumers should care about a product unavailable for sale. One big reason is the growth in the world population, which is projected to reach about 9.7 billion people by 2050. Since most people are meat eaters, this population growth will place added pressure on the food supply chain. Raising more animals for human consumption is an inefficient use of land and water resources. It also contributes to nearly 15% of greenhouse gasses. If we can find cleaner and more humane ways of producing meat, it should be a win-win for humanity and the environment.

What Do We Call It?

Many words have been used to describe cultivated meat products, including "clean meat" or "cultured meat." Other names that have been used in the media, for instance, include "lab-grown," "in vitro," "tissue-engineered,” and "artificial" meat. For this article, we're using "cultivated meat," a term the industry seems to lean toward.

What Is Cultivated Meat?

The science behind cultivated meat was first used in 1907 for medical research. More recently, the idea of using science for meat production took off after Dutch professor Mark Post at the Maastricht University presented the world's first cultivated hamburger in 2013 at a price tag of about $330,000. In the ten years since then, rapid breakthroughs have lowered the cost considerably, making them more commercially viable today.

UPSIDE Foods Cultivation Room

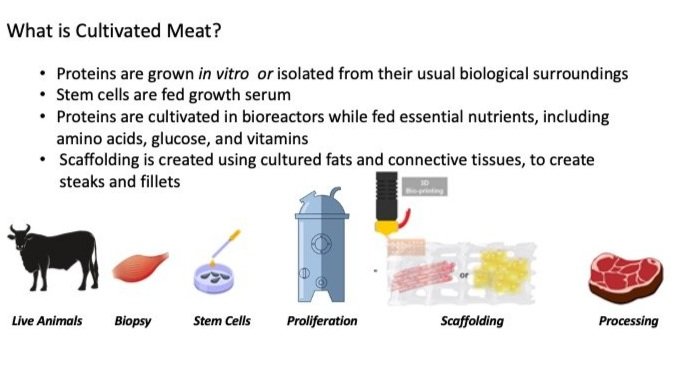

In the process of cultivating meat, according to the Good Food Institute, a leading advocate for both cultivated meat and vegan meat replacements, stem cells are taken from biopsies of live animals. Then, they are grown in bioreactors while fed essential nutrients such as amino acids, glucose, and vitamins. The process is estimated to take two to eight weeks, depending on the type of meat. Companies in the cultivated meat industry have pilot-tested cultivated meat, poultry, and seafood products and, pending approval from the United States Department of Agriculture (USDA), are getting close to full-scale production. According to Bioinformant, a stem cell research company, the first products will likely be ground meat or cultivated meat mixed with vegan filler. However, others speculate that Blu Nalu may be the first with its sushi-grade tuna.

According to Bioinformant, a stem cell research company, the first products will likely be ground meat or cultivated meat mixed with vegan filler. However, others speculate that Blu Nalu may be the first with its sushi-grade tuna. Ground meat products like nuggets or burgers are the simplest to cultivate. For whole meat cuts, a three-dimensional structure, or scaffolding, is layered with cultivated fats and connective tissues resulting in the desired shape and texture of steaks and fillets. For example, UPSIDE Foods, which recently opened a large-scale facility near San Francisco capable of cultivating 400,000 pounds of meat a year, has created a chicken fillet with the taste and texture of a natural chicken breast. Another San Francisco company, Wildtype Foods, is perfecting a sushi-grade salmon fillet. Meanwhile, Steakholder Foods, an Israeli company, has patented a novel approach using a 3D printer for cultivating steaks (more on this process later). These innovations come from a similar ethos but use their own proprietary methods.

Advantages of Cultivated Meat Over Conventional Meats

Wildtype Cultivated Sushi-Grade Salmon

Advocates promote cultivated meat's potential to meet the nutritional needs of an expected 9.7 billion global population by 2050. Although plant-based meat replacements are on the rise, about 90% of Americans are meat eaters, consuming an average of 273 pounds of meat annually. By 2030, meat producers must supply 97 trillion pounds annually to meet this demand, placing added stress on the nation’s natural resources.

Environmental factors play a big part in the rationale for cultivated meats. Traditional animal farming methods rely on large amounts of fresh water and land resources, adding an estimated 14.5% of greenhouse gases into the atmosphere. GFI states that cultivated meat can reduce emissions by over 90% and use as much as 95% less land and close to 80%less water than conventional beef. In addition, supporters say that lab-grown meat eliminates foodborne pathogens such as E. coli and Salmonella, common bacterial problems deriving from animal processing that infect humans and create epidemics. In addition to ending these pathogens, lab-grown meat eliminates the collateral use of antibiotics in livestock farming.

Good Food Institute, 2021

Regulatory Hurdles and Meat Industry Pushback

Because cultivated meat is a new technology, governments around the globe must develop regulations before it can be approved for sale to consumers. This falls under the jurisdiction of the Food and Drug Administration (FDA) and the USDA’s Food Safety and Inspection Service (FSIS) in the United States. The FDA recently approved the UPSIDE Foods cultivation process for chicken, a step closer to USDA approval to begin selling in the United States.

The potential of cultivated meat has the conventional meat and poultry industry concerned about threats to their business model. As a result, the National Cattlemen’s Beef Association (NCBA) and the North American Meat Institute (NAMI) are lobbying against labeling these new products as meat. In 2019 the NCBA launched a campaign touting natural meat versus what they call "fake" meat. In addition, meat industry advocates have successfully lobbied industry-friendly states to pass laws restricting the use of the term "meat" on cultivated or plant-based meat alternative products.

If the cultivated meat industry can use standard meat terminology in their labeling, it will give them marketplace legitimacy. Interestingly, despite the pushback from cattle ranchers, the biggest meat companies in the world, like Tyson, JBL, and Cargill, have all invested substantial financial resources in this technology. Ultimately, government agencies must sort through the interests of these competing industries and strike a balanced approach to labeling and other regulatory issues.

Companies in the Cultivated Meat Industry

Good Meat, a division of Eat Just, was the first company to gain approval to sell its cultivated chicken product in Singapore in 2020. Nearly 100 companies worldwide are developing products ranging from familiar beef and chicken to exotic offerings like sushi-grade tuna, lobster, and foie gras. In addition, another 40 companies provide key inputs, from growth serums to scaffolding, to support other companies’ production.

Many companies, like UPSIDE Foods, Good Meat, and Mission Barns, are located in San Francisco, adjacent to Silicon Valley and the tech industry. However, there are cultivated meat companies across the United States, including South Carolina, Illinois, Colorado, and Wisconsin.

Steakholder 3D Printed Steak

Around the globe, from Europe to South America and Australia, many startups are working on cultivated meats. Israeli companies include Steakholder, Believer, and Aleph Farms. Meanwhile, Mosa Meat and Meatable are in the Netherlands. China is a big player that could significantly impact the industry. With 1.4 billion people, around one-fifth of the world's population, and a lack of arable land, China has had to rely on imports for beef, pork, and poultry. Their current five-year agricultural plan includes an emphasis on cultivated meats and vegan meat replacements. While China already has plant-based meat alternatives on the market, little is known about their progress on cultivated meats.

Cultivated Meat Influencers

The cultivated meat industry also seeks legitimacy by recruiting high-profile chefs and industry leaders. For example, Blu Nalu has chef/restaurateur Roy Yamaguchi and Culinary Institute of America's president Tim Ryan on their advisory board. Meanwhile, Michelin-starred chef Dominique Crenn of San Francisco's Atelier Crenn has teamed up with UPSIDE Foods. Chef José Andrés has joined Good Meat, a division of Eat Just Inc, as one of their ambassadors. Additionally, Thomas Keller’s restaurant group has partnered with Mission Barns.

Production Barriers

To be commercially feasible, companies in the cultivated meat space must produce large quantities at affordable prices. However, meeting consumer expectations is a more significant challenge for the cultivated meat industry. Ground-meat products like burgers and chicken nuggets are the simplest to produce. The chicken nuggets introduced by Good Meat in Singapore consisted of ground chicken bound with a vegan filler. For steaks and fillets, the meat must be grown with edible scaffolding (think connective tissue) and fats to mimic whole animal muscles. Scaffolding consists of edible or biodegradable ingredients like modified starches, alginate, pectin, and cellulose. 3D bioprinting is a technique that, like more conventional 3D printing, uses parts that are stacked to create a physical product. In bioprinting, the 3D printer creates layers of living tissue to create scaffolding. The product is printed and then cultivated into a steak. Companies like Steakholder are explicitly focusing on a 3D printing process. However, many companies are developing patented strategies that are not publicly disclosed.

What the Skeptics Say

Some bioscience experts say cultivated meat will never become mainstream because scaling up technologies and other practical factors, such as production operations, will be too costly. An article in The Counter by Joe Fassler argues that the economics of cultivated meat don't add up. Another argument the report makes is that because the meat is grown in labs, it requires a sterile environment. Consequently, a few unfavorable bacteria can spoil whole batches if workers are lax on safety protocols.

From a cost perspective, The Counter article notes that fetal bovine serum (FBS) has been the go-to ingredient most companies use as a growth medium for producing cultivated meats. FBS is very costly and has been described as “unsustainable, unethical, and not scalable” because it is harvested from the blood of fetuses taken from pregnant cows. As a result, cultivated meat companies have been working on vegan replacements to reduce costs. In early 2022 Mosa Meats announced breakthrough technology that eliminated FBS from the process.

The early results of some studies hypothesized that cultivated meat would result in a much smaller carbon footprint. In contrast, other, more recent studies have reported that giant fuel bioreactors for producing cultivated meat will require more energy. Ultimately, much depends on the type of energy used, and the reality is that we will only know energy usage when production is happening.

The Future of Cultivated Meat

Consumer acceptance will ultimately determine if these products are successful. Surveys suggest consumers and chefs are open to purchasing and eating cultivated meats. Still, many need to be educated about this new product. It is up to the cultivated meat industry to develop marketing strategies to help meat eaters overcome suspicion of anything that sounds artificial. To ensure customer acceptance, cultivated meat providers must create products that compare to conventional meats in taste and texture. They must also increase production to provide a steady and reliable meat supply. Finally, costs must be reduced to be competitive with traditionally produced meats.

Some skeptics say cultivated meat can never be a reality. For example, Fessler’s report states that the hurdles are too significant for cultivated meat companies to become profitable. Still others, like the global consultancy AT Kearney, predict that within 20 years, most meat will be cultivated or plant-based. Given the rapid progress and capital pouring into this technology, the odds are that cultivated meat will soon become a reality. Whether it is a high-end delicacy like caviar and foie gras or used as a ground meat filler, there are many ways for cultivated meat to make its way into the food supply chain. The cultivated meat market share could easily reach billions of dollars with even a small percentage of the $1.4 trillion annual global meat sales.